Living debt-free is a major step to financial freedom. Luckily, there are many emerging options to help you pay off your loans at a manageable rate. Continue reading

Living debt-free is a major step to financial freedom. Luckily, there are many emerging options to help you pay off your loans at a manageable rate. Continue reading

Being financially independent is the first step to economic freedom. When you no longer rely on others for your expenses, you gain a new sense of control over your life. Read our tips below to help make this your new reality.

There are many reasons why loved ones may ask for money. Medical care, job loss, lack of credit for loans, and personal emergencies are all common situations people may need extra assistance with. Lending money to family and friends can be a kind gesture and a way to help.

A midwestern couple walks into a mall. They’re looking to get some exercise so they set their FitBits and 9,000 steps later they’ve dropped $500. If you’re waiting for a punchline, there isn’t one. They left the mall with three ramen bowls, two coats, a pair of Doc Martens, and a bag of Lindt truffles they didn’t need when they got there and still didn’t need when they left.

In a bleak economy that has split the “middle class” into three different subclasses, the 18 to 29 age group have more opportunities to go into debt than any generation that came before them. There is a lot of pressure to show success. So much so that more people are living beyond their means more than ever.

There is no doubt that the new year brings with it a sense of renewal, hope for a better life that spurs us toward New Year’s resolutions and annual tasks.

Did you know October is National Economic Education Month? Economic education is important for everyone because we all have to deal with money, and most of us worry about it.

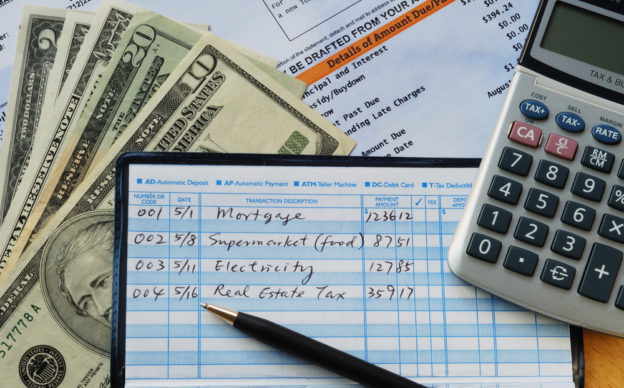

Managing your money is an essential part of financial planning that can set anyone up to have a successful future and meet critical milestones that are necessary to achieve financial security.

Have you ever heard of a ‘money personality’? Chances are, you have one. It might reveal more about you than you realize.

Recently, we explored why holiday checks make great gifts. Not only are they inherently more secure than gifting cash, they’re simply more festive — and the festivities don’t have to end at Christmas designs.