This Mother’s Day, we can celebrate all the ways our moms have helped shape us into who we are today–including our financial habits! Let’s take a look at some of the best money tips we’ve learned from our money-savvy moms.

Continue reading

This Mother’s Day, we can celebrate all the ways our moms have helped shape us into who we are today–including our financial habits! Let’s take a look at some of the best money tips we’ve learned from our money-savvy moms.

Continue reading

In your 20s, you may be juggling jobs, education, and relationships, but it’s wise to make sure your financial health is also being cared for. By starting with smart choices now, you can boost your comfort and success in your 30s and beyond.

Continue reading

Every dollar counts when it comes to small businesses. Luckily, there are a lot of quick and easy ways to reduce spending and prevent or overcome hard financial situations.

How far can $100 go? Check out these ideas for new ways to invest your extra money this month!

There are many reasons why loved ones may ask for money. Medical care, job loss, lack of credit for loans, and personal emergencies are all common situations people may need extra assistance with. Lending money to family and friends can be a kind gesture and a way to help.

A midwestern couple walks into a mall. They’re looking to get some exercise so they set their FitBits and 9,000 steps later they’ve dropped $500. If you’re waiting for a punchline, there isn’t one. They left the mall with three ramen bowls, two coats, a pair of Doc Martens, and a bag of Lindt truffles they didn’t need when they got there and still didn’t need when they left.

In a bleak economy that has split the “middle class” into three different subclasses, the 18 to 29 age group have more opportunities to go into debt than any generation that came before them. There is a lot of pressure to show success. So much so that more people are living beyond their means more than ever.

Did you know October is National Economic Education Month? Economic education is important for everyone because we all have to deal with money, and most of us worry about it.

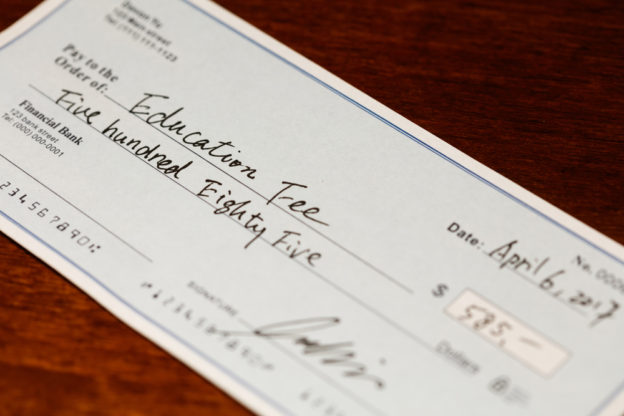

As you consider ways to prepare your college student for back-to-school, you might be wondering about how to equip them to handle their finances. Although it might not be the first thing that comes to mind, personal checks might be the way to go.

Have you ever heard of a ‘money personality’? Chances are, you have one. It might reveal more about you than you realize.