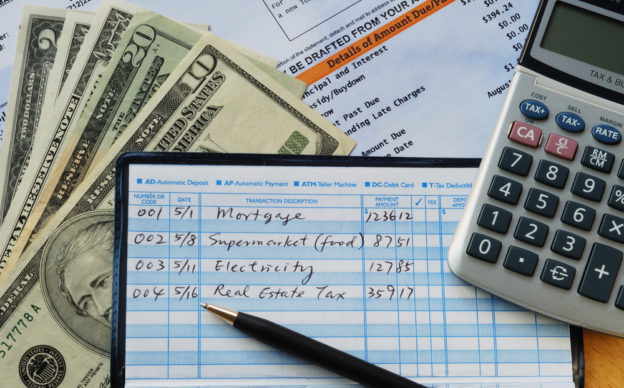

In your 20s, you may be juggling jobs, education, and relationships, but it’s wise to make sure your financial health is also being cared for. By starting with smart choices now, you can boost your comfort and success in your 30s and beyond.

Continue reading