Managing your money is an essential part of financial planning that can set anyone up to have a successful future and meet critical milestones that are necessary to achieve financial security.

Creating a dependable budget is a crucial part of any money management plan, and there are various ways to do so without having to depend on an app or digital service. These five simple steps will help you create a well-thought-out and trustworthy budget that will get you to your financial goals.

Step 1: Create a Simple Document

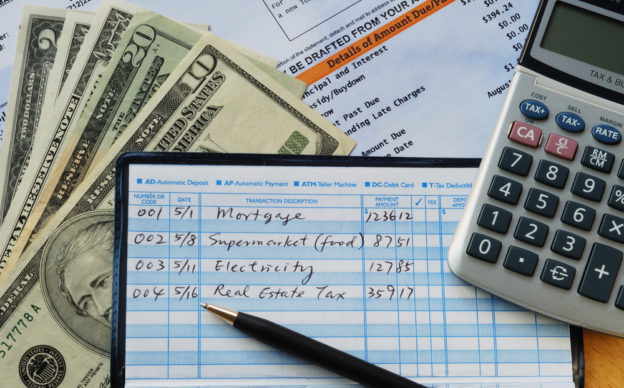

Finding a reliable and easy way to budget will ensure that you refer to it repeatedly. For example, building a spreadsheet using Microsoft Excel or Google Sheets works well, or a simple grid sketched in a notebook are both effective solutions that can be used to house a budget.

Step 2: Organize Your Budget by Recurring Expenses

The very first items that should make up your budget should be costs that don’t change each month, like car insurance, rent, phone bills, and any other stationary bills. Fluctuating necessary expenses such as utility bills, toiletries, groceries, and gas should be recorded next. Then, after your core spending is plotted out, you can allocate an amount for leisure expenses such as gifts, entertainment, and eating out.

Step 3: Figure out Exactly How Much Income You Have to Spend Each Month

Once all of your expenses are recorded, then you’ll need to determine your monthly net income. This number is the amount of actual cash you will have to spend each month, so make sure to eliminate any deductions such as tax or 401(k) payments that might be taken from your monthly income.

Step 4: Track Your Spending Carefully

Developing a budget is only your first step. To move the needle in your financial health spectrum, it’s important to actively use your budget and refer to it at least once a month. By doing this, you’ll be able to make any necessary adjustments and keep your spending on track. Checking your budget mid-month may also be essential if you find yourself getting off track by the end of the month.

Step 5: Work Towards Increasing Your Savings

After a couple of months have passed, you’ll be able to average even your changing expenses so you can get a better idea of how much money you have leftover for leisure and, eventually, savings. Once you reach this milestone, add a savings column onto your sheet so you can allocate a set amount to that each month as well.

This is especially helpful if you feel you’re living beyond your means and want to diagnose the problem. But if it’s too much work and you don’t have the time, you can also turn to some handy budgeting apps.

General Budgeting Tips to Remember

Balancing a budget takes practice. Getting used to tracking your expenses can take time, but practice and consistency will help you succeed. A few other tips that can help you track your spending are to keep a daily or weekly spending log, giving yourself a small award if you stay on track, and making minimum payments on outstanding debts.

Checks are also a great way to track your budget since they come with a register for you to mark all your payments and expenses.