As you consider ways to prepare your college student for back-to-school, you might be wondering about how to equip them to handle their finances. Although it might not be the first thing that comes to mind, personal checks might be the way to go.

As college students, a checkbook or credit card will likely be their first exposure to the world of managing money. Many young people might be tempted to blow their funds on fun experiences quickly, but providing your student with a checkbook could help them to learn to be responsible and avoid that pitfall.

A 2015 survey of 42,000 first-year college students revealed a relationship between the age that students were exposed to credit cards, and how confident they feel about managing their money in college. The nature of that relationship might be considered surprising: the earlier students were given credit cards, the less prepared they felt to manage their college funds.

Are checks better than credit cards?

There are things in life that do not mix well, and then there is the combination of college students and a perception of unlimited money. Credit cards might work to provide a financial ‘safety net’ – since account limits can be very high.

If your college student knows that they are in possession of a credit card to the value of $10,000, they are likely to engage in more frivolous purchases, or believe that they can impress their friends by covering fees for the latest pizza party.

A concrete, finite amount of money would be a much better way to teach your student about the value of money, and the importance of budgeting. With a checking account, it is much easier to monitor how money is being spent.

Of course, there might be scenarios where you feel your student is responsible enough, and could benefit by building their credit score by using a credit card in college. This situation could arise if they have been using checkbooks during high school, learning the value of money that they might have been earning with a part-time job.

However, credit cards are definitely a riskier bet than checkbooks. If your student forgets to make a single payment, it could play havoc with their credit score, and they could even incur fees. Overall, checkbooks are a safer way to manage money during college years.

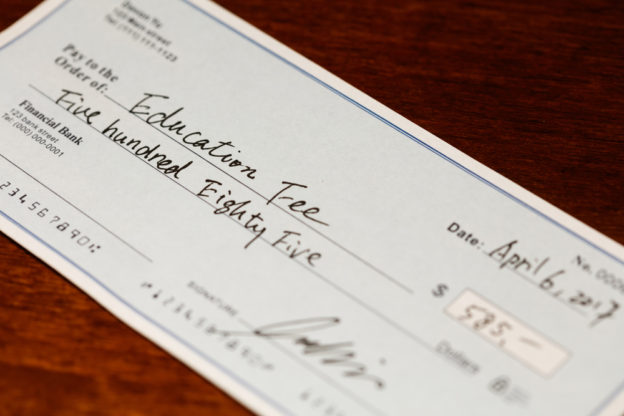

How student can use checkbooks

It is little use having a checkbook if your student won’t be recording their purchases and learning how to balance their checkbook. Balancing a checkbook teaches organization and practical money management skills.

- Check the ending balance on your monthly bank statement

- Note all deposits that were not shown on the statement

- Add all of these deposits and add this total to your bank statement balance

- Note all withdrawals that were not shown on the statement

- Add all of these withdrawals and subtract this total from your bank statement balance

After this, your bank account should accurately reflect the recordings made in your checkbook.

Checks also better prepare college student for the world of adult expenses. As they navigate the world of housing and utility bills, checks are still one of the more common forms of payment.

Following this method will encourage your student to record spending accurately, learning about their spending habits in the process. This will only help put them on the path to becoming financially-responsible graduates who know their limits.

Make checks even more fun by using them to show your school spirit!

Support your alma mater with our Collegiate Checks.