Whether you’re a young college student just getting started with adult life, someone in their 30s or 40s raising a family, or even in your middle age or beyond, there are always benefits to living frugally.

Continue reading

Whether you’re a young college student just getting started with adult life, someone in their 30s or 40s raising a family, or even in your middle age or beyond, there are always benefits to living frugally.

Continue reading

Taking initiative over your finances can sometimes be a confusing endeavor. After all, it seems like everyone has their own twist on personal financial advice.

Continue readingThe marketing department at Chase might be good at getting people to sign up for credit cards and home mortgages. However, they’re not all that good at explaining “the latte factor.”

Continue readingGoing green can help you protect the environment. However, many people are reluctant to go green because they think that it is too expensive. Going green is not as expensive as you may think. In fact, you may be able to save money by going green.

Continue readingHandling finances as a single person can be difficult. Add another adult with income into the mix, and the difficulty can expand. Frequently, a couple will have both a spender and a saver. This is why couples need to have a strategy when it comes to handling household finances.

Continue readingFinancial literacy involves teaching students the basics of money management. This includes things such as debt, budgeting, saving, and lending. The purpose of financial literacy courses is to set a foundation for students so that they can build strong money habits later in their lives.

As humans, we all have the vices that we would rather not have. Money definitely acts like one of those vices. For this reason, millions of Americans set money-related resolutions every New Year.

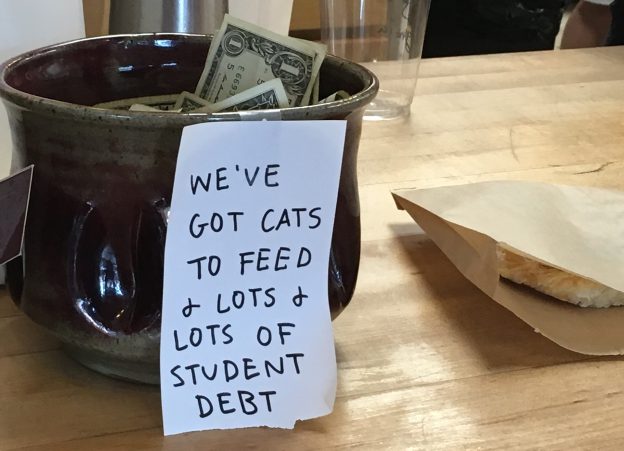

In most parts of the world, tipping is not mandatory, or even expected. However, in the U.S., you are expected to tip if you go to certain places and most people feel it is a moral obligation. Nonetheless, sometimes you find yourself at a loss on how much to tip for certain services.

Based solely on this headline, you may be wondering: What on earth is a money buddy? Let us clarify that, no, a money buddy is not someone who helps you spend money. Quite the contrary! A money buddy is a person capable of helping you manage your money properly.

In light of Hurricane Florence’s recent landfall in the Carolinas, it’s important to consider how natural disasters can impact your financial situation. Despite the emphasis placed on planning for an emergency in schools and throughout the media, many Americans remain unprepared and without a solid financial plan.