Financial literacy involves teaching students the basics of money management. This includes things such as debt, budgeting, saving, and lending. The purpose of financial literacy courses is to set a foundation for students so that they can build strong money habits later in their lives.

Tag Archives: personal finance

Preparing for the 2019 Tax Season

It’s a brand-new year, which means that tax season is upon the nation. You still have until April to figure out your taxes, but the new laws may slow your progress this year. Don’t worry about your 2019 taxes. Simply follow a few tips in order to ease any tension. The new rules will make sense as you get accustomed to the enhanced forms and various deductions.

Get started on your taxes with these tips and tricks.

Top 5 Financial Resolutions for 2019

As humans, we all have the vices that we would rather not have. Money definitely acts like one of those vices. For this reason, millions of Americans set money-related resolutions every New Year.

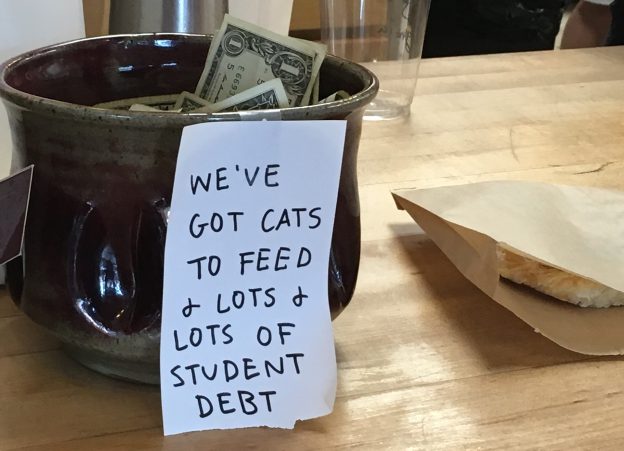

Guide to Tipping Etiquette

In most parts of the world, tipping is not mandatory, or even expected. However, in the U.S., you are expected to tip if you go to certain places and most people feel it is a moral obligation. Nonetheless, sometimes you find yourself at a loss on how much to tip for certain services.

The Benefits of Having a “Money Buddy”

Based solely on this headline, you may be wondering: What on earth is a money buddy? Let us clarify that, no, a money buddy is not someone who helps you spend money. Quite the contrary! A money buddy is a person capable of helping you manage your money properly.

Planning Financially for a Natural Disaster

In light of Hurricane Florence’s recent landfall in the Carolinas, it’s important to consider how natural disasters can impact your financial situation. Despite the emphasis placed on planning for an emergency in schools and throughout the media, many Americans remain unprepared and without a solid financial plan.

Benefits of Encouraging Your Teen to Work

Many parents are reluctant to encourage their teenagers to find a job. They worry it will be a challenge for teens to juggle work and school. However, this dynamic might actually teach them balance and better equip them with a sense of responsibility.

There’s a lot your teen can gain from a part-time job – and that’s not just extra spending money. Continue reading

5 Best Personal Finance Apps of 2018

Gone are the days of balancing checkbooks and keeping a budgeting journal. With our smartphones consistently at our fingertips, all financial matters are handled in the virtual world. We deposit checks, monitor our spending, and seek financial advice all on our smartphones. What’s more, we have the assistance of widely-lauded applications to make all of this easier.

Seize the Summer While Minimizing Spending

With summer in full swing, many people may already be feeling a pinch in their pocketbooks. Unlike the fall and winter seasons when people are more likely to want to cozy up at home and be hermits, the siren call of the warm sun and blue skies are irresistible to many wanting to make the most out of these glorious months. Continue reading

Millennial Money: Personal Finance Lessons from Millennials

Millennials have a false reputation of not being savvy with their finances. There seems to be a stereotype regarding money management that has adhered to this generation with no known cause. While millennials are inarguably faced with the largest debt burden compared to previous generations, they are using that drawback to exercise smart spending and saving skills. The fact is that millennials are actually quite creative and knowledgeable when it comes to their finances. They just save and invest in different ways than most other generations are accustomed to. Here are some lessons to take from the millennial generation. Continue reading