Handling finances as a single person can be difficult. Add another adult with income into the mix, and the difficulty can expand. Frequently, a couple will have both a spender and a saver. This is why couples need to have a strategy when it comes to handling household finances.

Continue readingTag Archives: Financial tips

Budget-Friendly Ways to Spend Valentine’s Day 2019

Valentine’s Day is here again! It is time to show the one you love just how much you love them. This time is filled with stores packedto the brim with red and white Valentine themed foods, chocolates, plush toys, clothing, and much more.

Continue readingHow & Why Finance Should Be Taught in Schools

Financial literacy involves teaching students the basics of money management. This includes things such as debt, budgeting, saving, and lending. The purpose of financial literacy courses is to set a foundation for students so that they can build strong money habits later in their lives.

Top 5 Financial Resolutions for 2019

As humans, we all have the vices that we would rather not have. Money definitely acts like one of those vices. For this reason, millions of Americans set money-related resolutions every New Year.

Best Budget-Friendly Gifts for Christmas 2018

The season for gift-giving has arrived, and for many this means making wise decisions that won’t break the budget. However, finding budget-friendly Christmas gifts is challenging. Here are the best budget-friendly Christmas gifts for 2018.

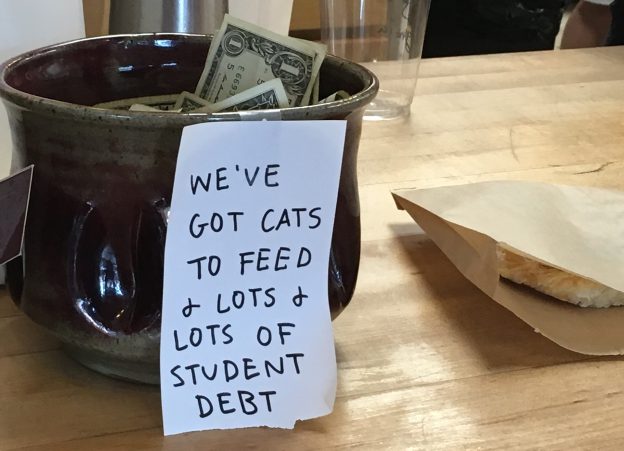

Guide to Tipping Etiquette

In most parts of the world, tipping is not mandatory, or even expected. However, in the U.S., you are expected to tip if you go to certain places and most people feel it is a moral obligation. Nonetheless, sometimes you find yourself at a loss on how much to tip for certain services.

The Benefits of Having a “Money Buddy”

Based solely on this headline, you may be wondering: What on earth is a money buddy? Let us clarify that, no, a money buddy is not someone who helps you spend money. Quite the contrary! A money buddy is a person capable of helping you manage your money properly.

5 Finance Tools Your Small Business Should Have

If you run a small business, managing your finances is one of your most important tasks. Fortunately, there are many fine software tools available that can help you do just this. Here are five finance tools your small business should make use of.

5 Best Personal Finance Apps of 2018

Gone are the days of balancing checkbooks and keeping a budgeting journal. With our smartphones consistently at our fingertips, all financial matters are handled in the virtual world. We deposit checks, monitor our spending, and seek financial advice all on our smartphones. What’s more, we have the assistance of widely-lauded applications to make all of this easier.

5 Great Side Gigs to Supplement Your Income

The internet has made finding additional sources of income so easy. Many people are taking their talents and learned skills, and applying them to side gigs. Between Uber, TaskRabbit, and countless other other similar services, supplemental work is more abundant than ever. In today’s article, we’ll be breaking down five side gigs that you can start today and will eventually pay off in the long run.