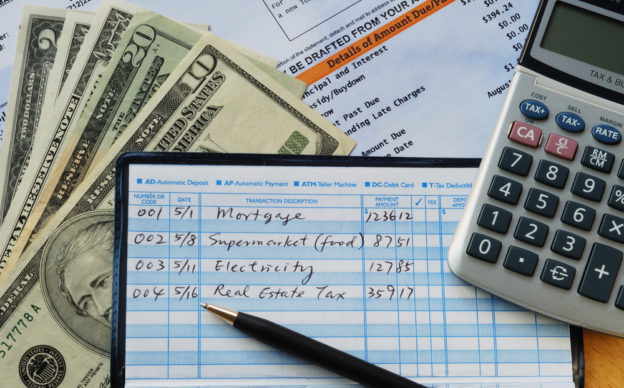

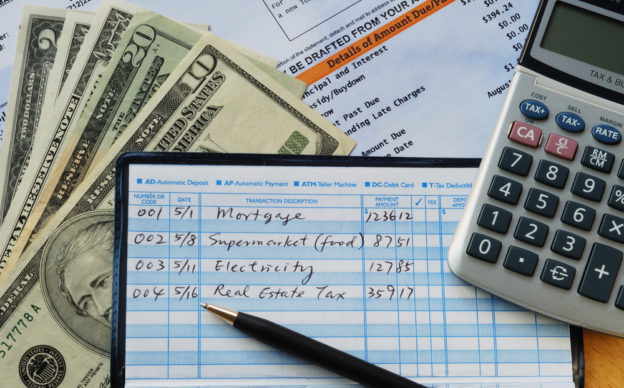

Managing your money is an essential part of financial planning that can set anyone up to have a successful future and meet critical milestones that are necessary to achieve financial security.

Managing your money is an essential part of financial planning that can set anyone up to have a successful future and meet critical milestones that are necessary to achieve financial security.

There is always so much to look forward to on Thanksgiving Day, from having friends and family over for dinner to playing games together and catching up on good times — and maybe even watching a little football.

Continue reading

Unfortunately, doing things the healthy way often also means doing things the more expensive way. However, there are still several ways that you can experience health on a budget and reduce how much you’re spending on these types of expenses.

Continue readingValentine’s Day is here again! It is time to show the one you love just how much you love them. This time is filled with stores packedto the brim with red and white Valentine themed foods, chocolates, plush toys, clothing, and much more.

Continue reading

As humans, we all have the vices that we would rather not have. Money definitely acts like one of those vices. For this reason, millions of Americans set money-related resolutions every New Year.

The season for gift-giving has arrived, and for many this means making wise decisions that won’t break the budget. However, finding budget-friendly Christmas gifts is challenging. Here are the best budget-friendly Christmas gifts for 2018.

Based solely on this headline, you may be wondering: What on earth is a money buddy? Let us clarify that, no, a money buddy is not someone who helps you spend money. Quite the contrary! A money buddy is a person capable of helping you manage your money properly.

Here’s a fun fact about Halloween that you might not have known: Believe it or not, it is reported to be the holiday that consumers spend the most to celebrate. Even beating Christmas!

If you are in the mood to join in on the festivities without busting your bank account, here are four budget-friendly tips to help you control your spending this spooky season.

Gone are the days of balancing checkbooks and keeping a budgeting journal. With our smartphones consistently at our fingertips, all financial matters are handled in the virtual world. We deposit checks, monitor our spending, and seek financial advice all on our smartphones. What’s more, we have the assistance of widely-lauded applications to make all of this easier.

With summer in full swing, many people may already be feeling a pinch in their pocketbooks. Unlike the fall and winter seasons when people are more likely to want to cozy up at home and be hermits, the siren call of the warm sun and blue skies are irresistible to many wanting to make the most out of these glorious months. Continue reading